"The reason is that I am a very stupid person...Every time I think it is time to give up that arrow and most importantly sell it..In fact, I do not need a financial advisor as much as I need a psychiatrist."

The previous phrases were mentioned by "Clashar files", Professor of Mathematics at the College of Bruyard in the US state of Florida, in his answer to a question that he was asked about the reason for not selling his possessions in the "Stedman American Andaltry" fund, which continued to record catastrophic results over the years.

Tomorrow that never comes!

From the fifties and through the sixties to the early 1970s, the "Kalahr" invested a total of a thousand dollars in the "Stedman American Instanti" fund..The last purchase of the shares of the fund on the part of the "Kalahr" was in 1974.From its time, the arrow comes from bad to worse, although the box industry in general was achieving good results at that time.

The arrow continues to decline and deteriorate, and "Kalahr" on the other side is convinced that he was involved in a bad arrow and must be abandoned, but at the same time he is afraid to sell it and its price will rise after that and miss that opportunity."Kalahr" continued this hesitant until June 1997, to find himself lost more than half of his original investment, which was only $ 434 left..

The funny thing is that the "Kalahar", if he gave up that stock in 1974 and put that thousand in another average performance fund, the value of that investment reached about 29 thousand dollars in June 1997.But "Kalhar" was stubborn and was unable to carry himself to sell that stock early.

Do you remind you of the story of "Kalahr" with something?The mistake in which this man made is very common in the stock market, in which amateurs and experts are located.Many investors find it difficult to accept the loss, which leads them to keep their losing shares for longer periods than necessary.

The reason for your involvement in this trap stems from your unwillingness to admit that you were wrong when you invested in that stock.While you delay you, you wish yourself false hopes and blindness.In the absence of any logical reason, you convince yourself that the arrow will somehow to restore its well -being and return to its previous level.But even if this really happened after years, do you have an idea about how many opportunities you lost while sitting alongside that arrow?

Hope kills them!

20 years ago, specifically in 1998, "Terns Odan", a professor of economics at Berkeley University, published a study entitled "Are investors hesitating to recognize their losses?"I concluded that investors tend to sell winning stocks and keep the weakest shares.

The inclination of investors to keep the losing stocks is called "Disposition Effect" or "The Effect of Liquidation of the Center", which is a term formulated by the professor of economics "Hirsch Chevren" and the financing professor "Meir Statman" while trying to apply behavioral sciences to the stock market.

The two found that investor decisions are going through a series of mental accounts when it comes to selling shares, because they are afraid of making a wrong movement and selling the stock at an inappropriate time.Thus, they continue to keep these stocks and sell their winning counterparts, which ultimately affects the quality of the portfolio.

But why do investors do that?Simply why the majority occurred in this trap is their conviction that there is always a possibility that the arrow will be bounced, and if that happens, they will be able to achieve a small profit or sell it at least the same price that they bought..

But what some people forget is that there is also a possibility that the stock will continue to decline.But even in light of the existence of this possibility, the researchers found that the investors, when they choose between giving up the arrow and exiting it with a simple loss and continuing to keep it, most of them choose to keep it..

False hope may be the most powerful thing to destroy the investment portfolios.While the investor sits, putting his hand on his cheeks, waiting for the arrow to recover and reflect his loss, the stock continues to deteriorate and his capital erodes.There are many examples of similar facts.Since we will not be able to set examples from the local market so that we are not accused of bias against "S" or "Y" we will be satisfied with referring to international companies, the investors sat next to them, waiting for a recovery that never came: Look, for example, to "General Motors" and "City Group".

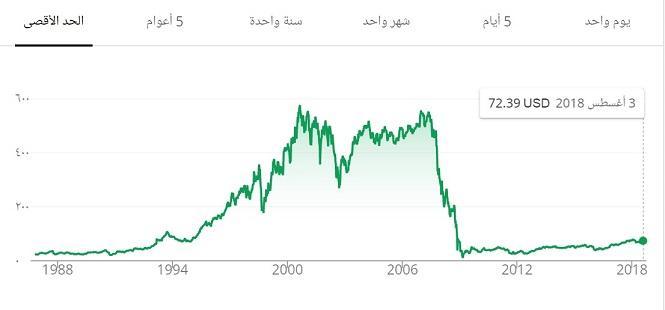

The following graph shows the developments of the price of "City Bank" during the past thirty years.There are those who bought this stock at its peak in 2007 before it deteriorated during 2008 and loses most of its value, but it continues to keep it from then in the hope that the arrow will recover one day and compensate for its loss..10 years have passed and are still steadfast!

Sometimes it is possible that the investor's refusal to accept the loss in pushing him to enter into unaccounted adventure.Perhaps one of the most famous examples of this is an incident that occurred in 1995, during which an employee of a bank caused the bank to lose more than one billion dollars and the loss of the bank’s president for his position.

"Nick Leson" was working as a derivative trading merchant that carried out trading activities that are not authorized on those contracts.With the passage of time, he began to lose money, but instead of putting an end to those losses, he refrained from selling contracts - that is, the loss on paper remained - and he hid those transactions from the bank’s president and entered into a complex series of bets, trying to compensate for his losses.

After losing these bets also, "Leson" fled to Singapore in February 1995, leaving the temple collapsing over the head of the bank's president who was exempt from his post after days against the background of the bank’s loss 1..4 billion dollars.After several weeks, he was arrested, and in his defense of himself in front of the investigators, he said, "Leson": "I have bet on the stock market to remedy my mistakes and save the bank.".

Part of the game

As an investor in the stock market, you desperately need to be rational.Do not take it personally.Let us assume, for example, that you decided to buy the company's share "S", which has been making good rises for a while, but then reflected its way and began to deteriorate.This decline is not necessarily temporary, it may be a reflection of the deterioration of the company's basics.Check the matter and if the reason is really related to the basics of the company.that simple.

In fact, the treatment of this problem begins with the investor's awareness that the loss is part of the indivisible of the game, and that investment is essentially only a possibility activity.As investors in the stock market, we are trying to do our best to examine and scrutinize to build a possibility of gain more than the possibility of loss.But at the same time we realize that we are facing risks.

When many evidence indicates that we may have not been successful in our choices from the beginning, some of us try to stand up to the market, and in fact, no one is stubborn except by continuing to believe that the day will come when he will understand the market, because of his refusal to accept the idea that his wrong choice isCost.

In fact, the question that we can ask them is: You want to be right or do you want to earn money?

Today, in the Saudi stock market and other international markets there are many promising opportunities that appear every moment, and it is not intelligence that the investor misses these opportunities because he is besieging himself with a group of losing stocks that he believes has lost the way that will return to him one day.Why should future opportunities be hostage to the bad past decisions?

Finally, think about the money you lost because of your wrong investment decisions that you have taken in the past as the costs of exorbitant study fees that you paid to learn a lesson they do not know in universities, and thanks to it it became a better investor..Once again, it is resolved with a sports spirit and accepts the loss in the stock market.